EKINOPS (Euronext Paris – FR0011466069 – EKI), a leading supplier of telecommunications solutions for telecom operators and enterprises, is publishing its financial statements for the year ended December 31, 2022, as approved by the Board of Directors on March 6, 2023. The statutory auditors have finished auditing procedures and the certification report will be issued shortly.

Acceleration of growth dynamic in 2022: +23% growth in revenue

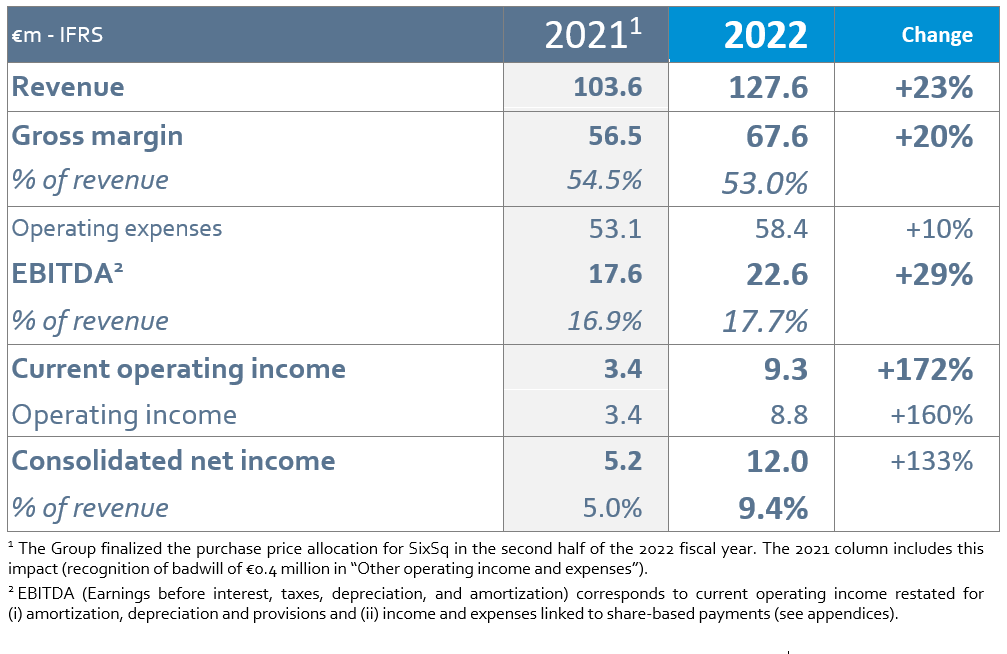

In 2022, Ekinops generated consolidated revenue of €127.6 million, up +23% from FY 2021 at constant scope (up +19% at constant exchange rates).

2022 was marked by an acceleration of growth momentum, which rose from +12% in 2021 to +23% in 2022, despite persistent supply difficulties for certain electronic components which only now are starting to subside.

This sustained growth was the result of strong demand for all the group’s business lines: +29% for Optical Transport solutions and +20% for Access solutions. The revenue generated by Software and Services continued to grow, increasing by more than +38%, representing 15% of the group’s revenue in 2022.

In geographic terms, the financial year was marked by ongoing dynamic growth internationally, with +56% growth in North America (+39% in USD) and +38% growth in Asia-Pacific. In France, sales grew by +36% and were sharply up with the group’s historic customers.

+29% growth in EBITDA1, record annual EBITDA1 margin of 17.7%

Despite the global component crisis, the gross margin was up +20% in 2022 to €67.6 million.

In a severely disrupted market environment, the gross margin was 53.0%, within the long-term target range (52% - 56%), as a result of sound management of the supply chain and of by passing on a proportion of pricing tensions through sale prices.

EBITDA[1] was €22.6 million, up sharply by +29%. The rise in operating expenses was limited in 2022 (+10%), while necessary investments in the group’s development and growth continued (recruitment, acquisition of R&D equipment, resumption of attendance of trade fairs and international travel).

The EBITDA1 margin reached record levels in 2022, and for the first time exceeded 17% over a full fiscal year, at 17.7% (vs. 16.9% in 2021 and 15.9% in 2020). It ended up at the high end of the 14%-18% range targeted for FY 2022.

Adjusted EBIT2 margin of 12.2%

After net depreciation, amortization and provisions (€11.1 million including €6.3 million in amortization related to technologies after purchase price allocation) and expenses relating to share-based payments (€2.3 million), current operating income rose to €9.3 million in 2022, up 172% year-on-year. The current operating margin was 7.2%, compared with 3.3% a year earlier.

Excluding amortization related to the intangible assets identified post purchase price allocation, adjusted EBIT[2] was 12.2%.

After factoring in other operating income and expenses (€0.5 million), operating income was up +160% to €8.8 million.

After accounting for €1.2 million in financial income from foreign exchange gains and the recognition of a positive tax result of €2.0 million from the use of tax loss carryforwards[3], net income rose +133% in 2022 to €12.0 million.

Net margin also reached a record level of 9.4% (vs. 5.0% in 2021 and 3.4% in 2020).

Earnings per share (EPS) more than doubled in 2022 to reach €0.45 per share, compared with €0.20 per share in the previous year (on fully diluted basis).

Net cash[4] of €20.5 million at December 31, 2022

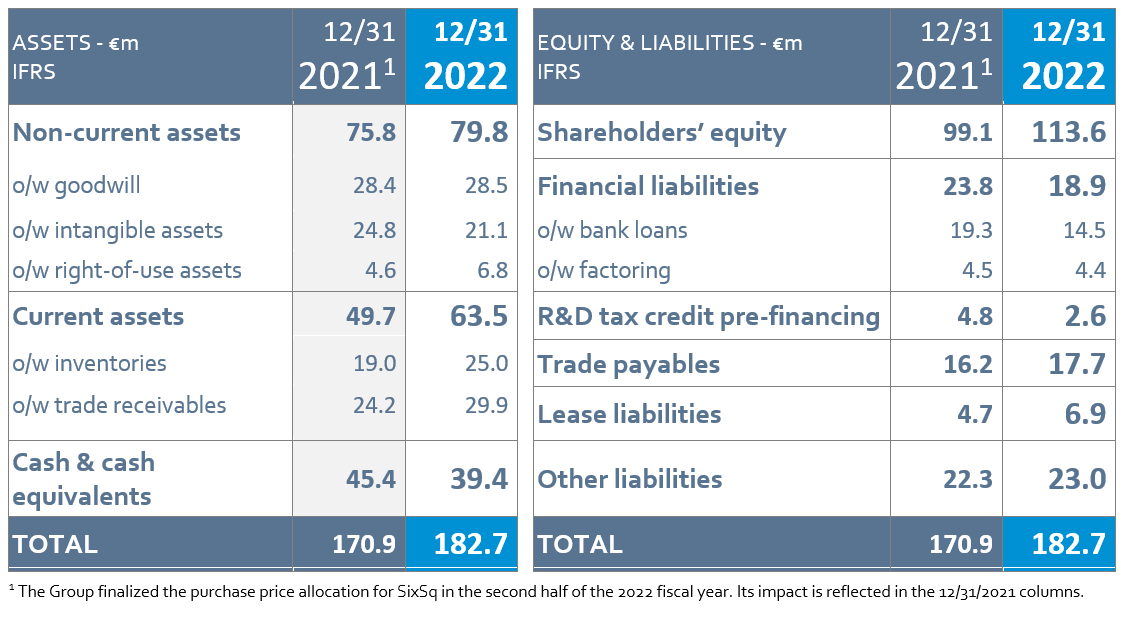

Ekinops’ strong operating performance in 2022 led to a +39% increase in cash flow to €23.6 million before working capital needs.

As a result of an increase in working capital (+€13.6 million) due to (i) active anticipated purchasing of components to address supply shortages (+€6.0 million of inventory at end-2022 compared with 2021)

and (ii) end of quarter high business activity (a +€5.5 million net increase in trade receivables), operating cash flow over the year was €9.4 million (compared with €12.5 million in 2021).

Cash flow from investments was -€7.4 million, including -€4.1 million of capitalized R&D expenditure. Free cash flow in 2022 was +€2.0 million.

Cash flow from financing activities (-€8.2 million) reflected the significant deleveraging carried out by the group in 2022, with the repayment of €6.9 million of bank loans (including decrease in R&D tax credit financing).

In total, cash and cash equivalents reduced by €6.0 million (-€4.2 million in 2021).

Cash and cash equivalents stood at €39.4 million at the end of 2022, with financial borrowings[5] reduced to €18.9 million (€23.8 million at the end of 2021 and €31.6 million at the end of 2020). Net cash4 position remained solid at €20.5 million at December 31, 2022 (vs. €21.6 million a year earlier).

2023 and beyond: the strategic initiatives to drive Ekinops onwards and aim “Bigger”

2022 demonstrated the Group’s ability to increase its market share with its differentiated offerings in various business segments and meet its customers’ needs and tight deadlines.

As a result, Ekinops has set itself bold growth ambitions for coming years, structured around 4 strategic priorities entitled “Bigger”:

- “Bigger” in terms of external growth: as it operates in a global market dominated by large multinationals, Ekinops is looking to accelerate its growth through acquisitions with a view to scaling up its R&D firepower, increasing its customer base and continuing on its sharp growth trajectory. One of the Group’s objectives in 2023 is to complete at least one transaction during the year favoring a non-dilutive source of financing.

- “Bigger” in terms of customer portfolio: One of Ekinops’ growth priorities is its positioning with major international customers, to provide support in their strategic network and technological developments. This ambition will result in increased sales with existing key accounts and the acquisition of new major customers.

Over time, Ekinops aims to be a reference brand in the telecom universe, working with the largest telecom operators worldwide.

- “Bigger” in technological terms in Edge, Metro and the Cloud: in recent years, Ekinops has chosen to provide innovative, open and interoperable solutions for telecommunication networks. Transformation of the telecommunication market in recent years requires this type of technology, with:

- increasing levels of data processing at the edge of the network (Edge), such as routing, voice, SD-WAN, etc.;

- a growing need for optimized optical transport solutions for metro networks (combining OTN and WDM);

- cloud solutions and platforms to manage and supervise networks and deliver new services such as PaaS (Platform as a Service).

As a pioneer in virtualization, which can be used to uncouple software and platforms, and as a result of its commercial success in this technological segment, Ekinops intends, over the coming years, to become a major player in these three areas by supplying service providers with equipment and, increasingly, software and services that are regular and recurring sources of revenue.

- “Bigger” in terms of ESG (Environmental, Social & Governance): To address the challenges of long-term value creation and in order to generate sustainable growth, Ekinops is intending to strengthen and accelerate its ESG actions that are focused on three key initiatives: (i) limiting the environmental impact of its business activities through energy efficient solutions ; (ii) becoming a leading and engaged employer to ESG, and (iii) acting as a responsible corporate citizen with its stakeholders. These commitments take the form of precise concrete objectives applicable to all aspects of the Group’s business activities.

2023 financial targets

As a result of high levels of demand at the beginning of 2023, Ekinops has set itself the following targets for the current fiscal year:

- revenue growth of more than +12%;

- EBITDA margin between 15% and 19%, including human and technological investments to support its growth.

2023 financial calendar

|

Date |

Release |

|

April 13, 2023 |

Q1 2023 revenue |

|

May 24, 2023 |

General Meeting |

|

July 11, 2023 |

Q2 2023 revenue |

|

July 27, 2023 |

H1 2023 results |

|

October 11, 2023 |

Q3 2023 revenue |

|

January 10, 2024 |

FY 2023 revenue |

All press releases are published after Euronext Paris market close.

[1] EBITDA (Earnings before interest, taxes, depreciation and amortization) corresponds to current operating profit restated for (i) amortization, depreciation and provisions, and (ii) income and expenses relating to share-based payments (see appendices).

[2] Adjusted EBIT corresponds to current operating income adjusted for amortization charges related to intangible assets identified post purchase price allocation, i.e. developed technologies and customer relation.

[3] As of December 31, 2022, the potential tax savings from unrecognized tax loss carryforwards was €13.4 million.

[4] Net cash = cash and cash equivalents – borrowings (excluding bank debt relating to R&D tax credit (CIR) pre-financing and IFRS 16 lease liabilities).

[5] Financial debt excluding bank debt relating to R&D tax credit pre-financing and IFRS 16 lease liabilities.

About Ekinops

Ekinops is a leading provider of open, trusted and innovative network connectivity solutions to service providers around the world. Our programmable and highly scalable solutions enable the fast, flexible, and cost-effective deployment of new services for both high-speed, high-capacity optical transport as well as virtualization-enabled managed enterprise services.

Our product portfolio consists of three highly complementary product and service sets: EKINOPS360, OneAccess and Compose.

- EKINOPS360 provides optical transport solutions for metro, regional and long-distance networks with WDM for high-capacity point-to-point, ring, and optical mesh architectures, and OTN for improved bandwidth utilization and efficient multi-service aggregation.

- OneAccess offers a wide choice of physical and virtualized deployment options for access network functions.

- Compose supports service providers in making their networks software-defined with a variety of software management tools and services, including the scalable SD-WAN Xpress and SixSq Edge-to-Cloud solutions.

As service providers embrace SDN and NFV deployment models, Ekinops enables future-proofed deployment today, enabling operators to seamlessly migrate to an open, virtualized delivery model at a time of their choosing.

A global organization, Ekinops (EKI) - a public company traded on the Euronext Paris exchange operates on four continents.

Name : EKINOPS

ISIN Code : FR0011466069

Mnemonic code : EKI

Number of shares: 26,505,946