EKINOPS (Euronext Paris - FR0011466069 – EKI), a leading supplier of telecommunications solutions for telecom operators and businesses, has published its financial statements for the year ended December 31, 2020 as approved by the Board of Directors on March 2, 2021. The statutory auditors have finished auditing the financial statements and the certification report will be issued shortly.

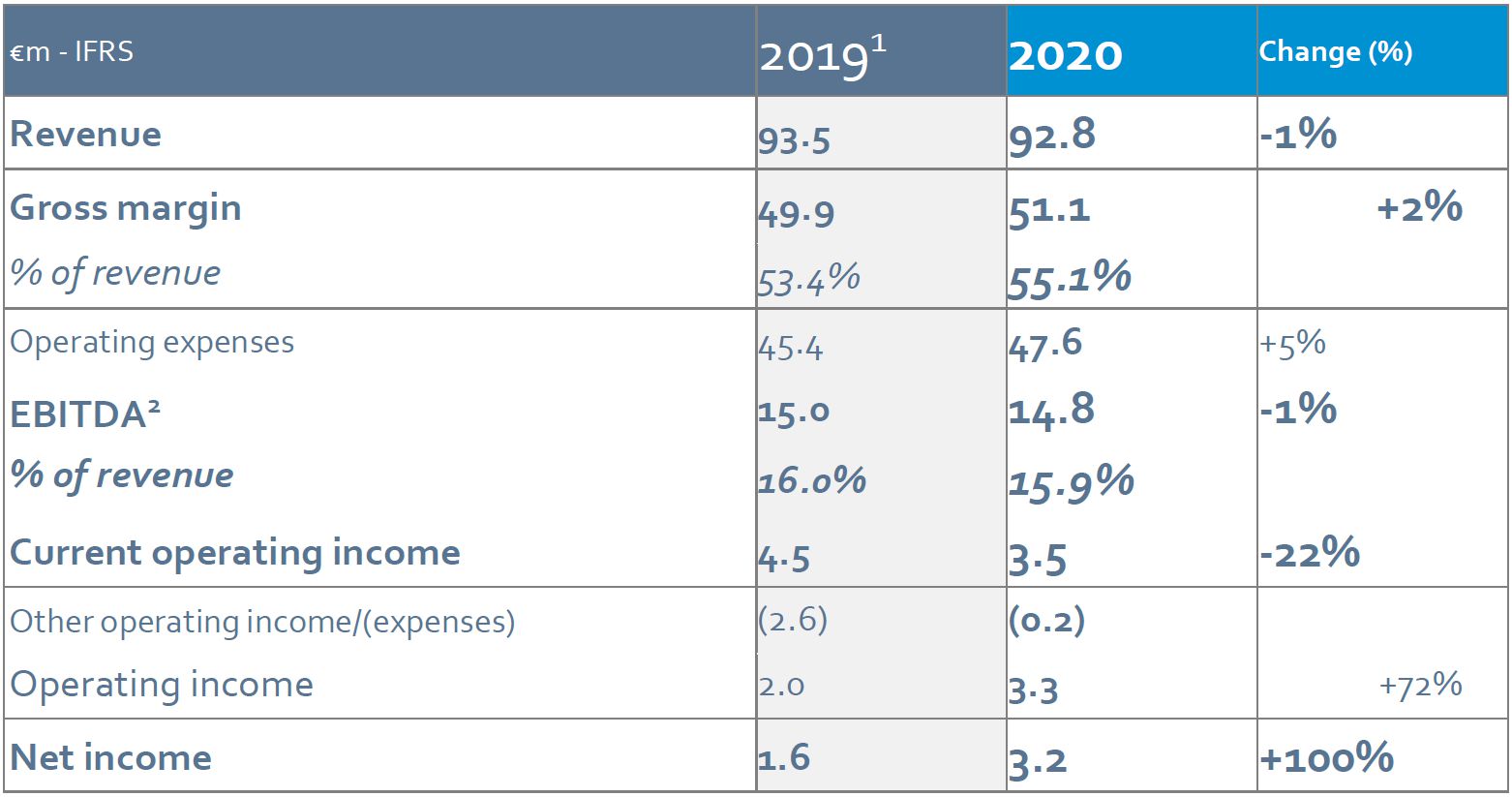

Full-year consolidated revenue for 2020 slid 0.8% to €92.8 million. At constant exchange rates, full-year revenue edged up 0.2%, reflecting the Group’s strong performance in a market disrupted by the pandemic and its economic consequences.

Ekinops recorded major commercial successes in 2020 with the new offerings, especially in virtualization, SD-WAN and OTN solutions which acted as a catalyst for WDM product sales. In the access market, sales of high value-added mid-range routers doubled, making a further contribution to the improvement in margins.

In terms of regions, the Group posted strong growth in France (up 9%) and the USA (up 3% at constant exchange rates). The EMEA region (Europe excluding France, Middle East & Africa) saw a limited 2% decline in full-year sales (flat at constant exchange rates), while the Group returned to growth in the second half with sales up 8%. Most heavily impacted by the health situation and lockdown measures, the Asia-Pacific region posted a 24% decline in 2020.

55.1% gross margin rate, above the target range

2020 gross margin came to €51.1 million, up €1.2 million from 2019. This resulted in a gross margin rate of 55.1%, up 1.7 point from 53.4% in 2019 and just above the 50-55% target range set by the Group.

Besides tightly controlling production costs, the Group continued to reap the benefits of its upmarket strategy, as the growing success of new solutions contributed to improving the product mix and margins.

Robust 2020 EBITDA margin: 15.9%

2020 EBITDA amounted to €14.8 million, down only €0.2 million from 2019 EBITDA. The control of the cost structure, despite a disrupted environment and without the Group having to resort to partial unemployment throughout the year, enabled the company to achieve a robust 15.9% EBITDA margin, just below the 16.0% all-time high achieved in the previous year.

The €2.2 million year-on-year increase in operating expenses (including €1.2 million depreciation and amortization charges) was due to the expansion of the R&D teams (7 new hires excluding the R&D team acquired in Brazil) and the full-year impact of the expenses incurred by the OTN business in Brazil acquired in July 2019.

Other operating expense items were kept well under control in 2020, with sales and marketing expenditure down 3%, mainly due to savings on travel expenses, and overheads and administrative costs down 9% including a major reduction in share-based payment expenses versus 2019.

After net depreciation, amortization and provisions (€10.4 million) and non-cash expenses relating to share-based payments (€0.9 million), current operating income amounted to €3.5 million (3.8% of revenue) in 2020.

Given the absence of material non-recurring income and expense items in 2020, operating income came to €3.3 million, up from €1.9 million in 2019.

After €1.3 million of financial expenses (including €0.8 million currency losses) and the utilization of €1.2 million deferred taxes, net income, Group share came to €3.2 million, double the 2019 figure (€1.6 million).

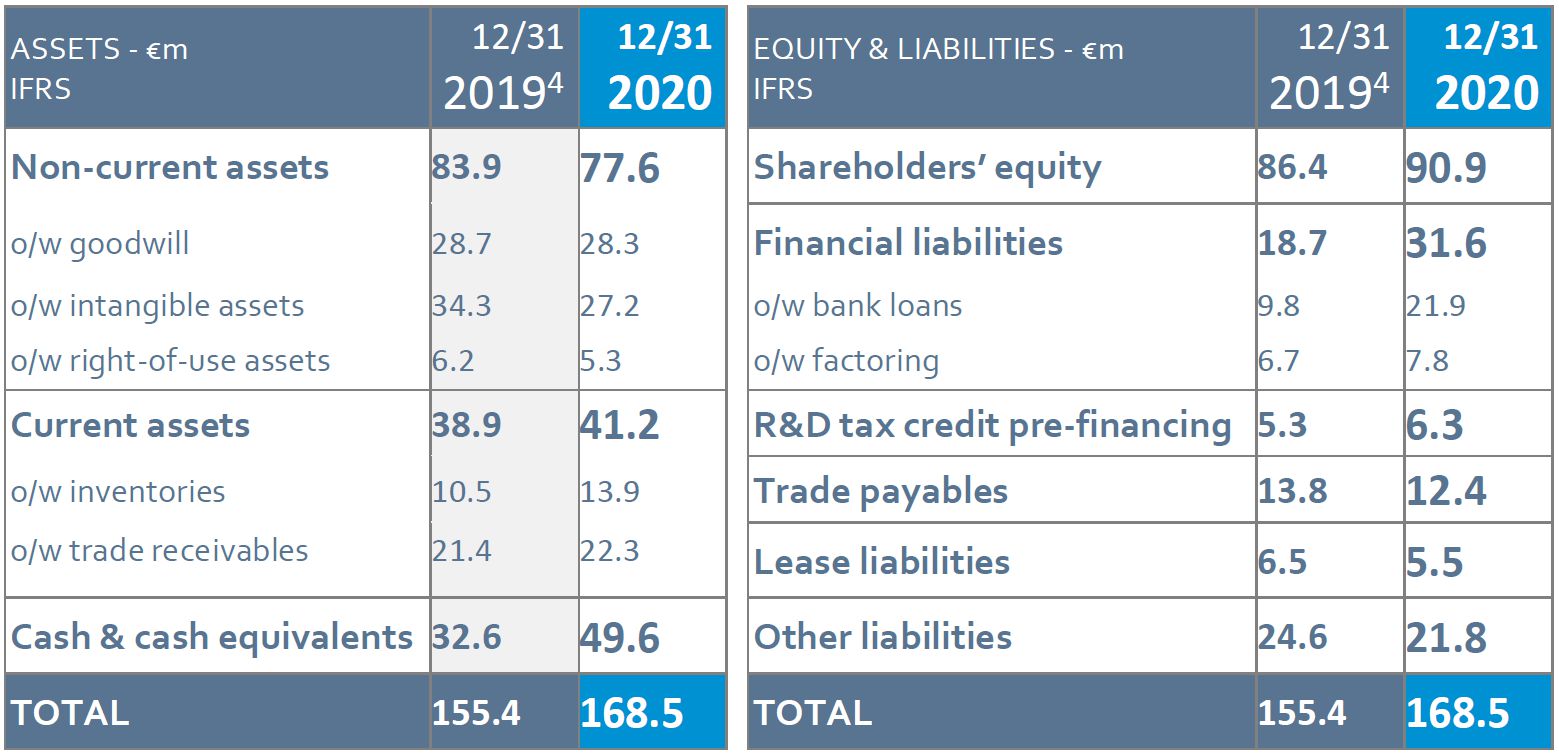

Net cash3 up €4.1 million to €18.1 million as of December 31, 2020

In 2020, Ekinops generated cash flow before taxes and net borrowing costs of €13.8 million, up 11% versus 2019. Working capital increased by €5.6 million in 2020, mainly due to the year-end inventory-building policy designed to forestall supply issues with certain electronic components. Operating cash flow amounted to €7.2 million in 2020.

Cash flow from investing activities amounted to a €4.9 million outflow of which €4.3 million of CAPEX (non-current assets and R&D capitalization) and €0.6 million for the purchase of minority interests from former OneAccess shareholders.

Cash flow from financing activities amounted to a €14.9 million inflow in 2020, boosted by (i) new bank borrowings totaling €12.7 million net of repayments, including €12.5 million under government support schemes to help businesses cope with the pandemic (PGE state-guaranteed loans in France and PPP Paycheck Protection Program in the USA) and (ii) a €3.3 million capital increase following the exercise of options by employees share-based payment plans.

The overall change in cash and cash equivalents was a €17.0 million increase in 2020.

As of December 31, 2020, cash and cash equivalents amounted to €49.6 million versus borrowings of €31.6 million. Ekinops continued to benefit from a highly robust financial position, posting net cash3 of €18.1 million at 2020 year-end up from €14.0 million the previous year.

Outlook

Although it is still too early to envisage a sustained market recovery given the prolongation of the health crisis in 2021, so far the signs in terms of operator investment are encouraging.

That said, current worldwide pressure on the supply of certain electronic components is likely to curb global equipment production in the first half and delay deliveries to operators in the second half. In response to this situation, toward the end of 2020 Ekinops pursued a policy of building surplus inventory and ordering certain component categories in advance. The Group is currently adopting a stance of cautious optimism in the hope that these supply problems will have a limited impact on its business.

At this stage of the year, Ekinops plans to continue to outperform its markets and main competitors, then step up the pace of growth as and when the effects of the health crisis begin to wear off.

The major commercial successes of 2020 confirmed Ekinops’ leadership in key technology areas serving new-generation operator networks (virtualization, SDN and SD-WAN, 10 GB/s connectivity and 5G enterprise routers in access, OTN, etc.). This technology leadership and the efforts expended on business development and winning new accounts in 2020 will further boost growth as market demand rises.

2021 financial targets

Ekinops continues to pursue its long-term trajectory towards double-digit growth. Progress towards this goal in 2021 will depend on the increase in demand over the coming months as and when the effects of the health crisis begin to wear off. Ekinops has set a mid-year deadline for confirming this target for 2021.

Regarding gross margin, the upmarket strategy and increasing role of software solutions in the equipment offering have prompted the Group to raise its target range. As from 2021, Ekinops has decided to aim for a long-term gross margin rate in the 52-56% range, compared to the previous range of 50-55%.

In terms of operating performance, Ekinops is aiming at an EBITDA margin of 12-16% in 2021 while continuing to hire the staff required to drive its innovation policy and business development strategy.

Relying on its very sound financial position, Ekinops intends to continue pursuing all external growth opportunities that would create value for the company.

2021 financial calendar

|

Date |

Release |

|

April 12, 2021 |

Q1 2021 revenue |

|

May 27, 2021 |

General Meeting |

|

July 12, 2021 |

Q2 2021 revenue |

|

July 29, 2021 |

H1 2021 results |

|

October 12, 2021 |

Q3 2021 revenue |

|

January 12, 2022 |

FY 2021 revenue |

|

March 8, 2022 |

2021 annual results |

All press releases are published after Euronext Paris market close.

1 On June 30, 2020, the Group finalized the purchase price allocation of Ekinops Brasil. Certain items were impacted by the retroactive effect of this purchase price allocation. The “2019” column includes these impacts.

2 EBITDA (Earnings before interest, taxes, depreciation and amortization) corresponds to current operating income restated for (i) amortization, depreciation, provisions, and (ii) charges related to share-based payments.

3 Net cash = cash and cash equivalents – borrowings (excluding bank debt relating to CIR pre-financing and IFRS 16 lease liabilities).

4 On June 30, 2020, the Group finalized the purchase price allocation of Ekinops Brasil. Certain items were impacted by the retroactive effect of this purchase price allocation. The “December 31, 2019” column includes these impacts.

About Ekinops

EKINOPS is a leading provider of open and fully interoperable Layer 1, 2 and 3 solutions to service providers around the world. Our programmable and highly scalable solutions enable the fast, flexible and cost-effective deployment of new services for both high-speed, high-capacity optical transport as well as virtualization-enabled managed enterprise services.

Our product portfolio consists of three highly complementary product and service sets: EKINOPS 360, OneAccess and Compose. EKINOPS 360 provides optical transport solutions for metro, regional and long-distance networks with WDM for high-capacity point-to-point, ring and optical mesh architectures, and OTN for improved bandwidth utilization and efficient multi-service aggregation.

OneAccess offers a wide choice of physical and virtualized deployment options for Layer 2 and Layer 3 access network functions.

Compose supports service providers in making their networks software-defined with a variety of software management tools and services, including the scalable SD-WAN Xpress. As service providers embrace SDN and NFV deployment models, EKINOPS enables future-proofed deployment today, enabling operators to seamlessly migrate to an open, virtualized delivery model at a time of their choosing.

A global organization, EKINOPS (EKI) - a public company traded on the Euronext Paris exchange - is headquartered in Lannion, France, and EKINOPS Corp., a wholly-owned subsidiary, is incorporated in the USA.

Name : EKINOPS

ISIN Code : FR0011466069

Mnemonic code : EKI

Number of shares: 25,614,322