Ekinops (Euronext Paris - FR0011466069 – EKI), a leading supplier of telecommunication solutions for telecom operators and businesses, reports Q2 2022 revenue (April 1 to 30 June 2022).

Acceleration of growth in Q2 2022: €35.5m, up +29%

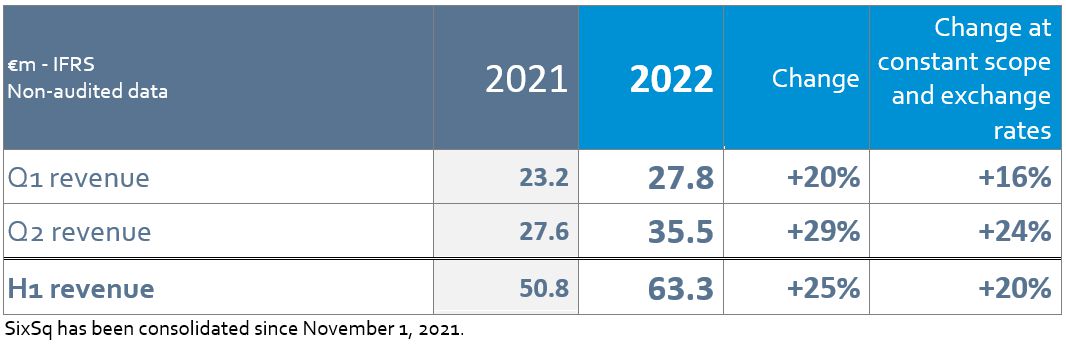

With growth of +29%, Q2 2022 revenue reached a new peak for Ekinops. The Group’s consolidated revenue stood at €35.5m, vs. €27.6m a year earlier. At constant scope and exchange rates, quarterly growth stood at +24%.

Over H1 2022, revenue amounted to €63.3 million, vs. €50.8 million in H1 2021, an increase of €12.5m. This solid level reflects robust growth of +25% relative to H1 2021 and +20% relative to the H2 2021, which traditionally contributes more.

At mid-year 2022, the group is therefore well ahead of its full-year target for revenue growth in 2022 to be at least equal to 2021 growth (+12%) and pushing towards +15%.

Growth in all business lines, with Software & services up +47%

The robust half-year performance was driven by growth in all the Group’s business lines (Optical transport, Access and Software & services). In the wake of 2022, the Optical transport activity was particularly buoyant, with robust growth of +31% relative to H1 2021, thanks to the success of 200 Gb/s and 400 Gb/s WDM systems.

Over the period, momentum in Access solution sales was also strong in all regions, with +21% growth compared to H1 2021.

Driven by the success of SDN (Software Defined Networks) solutions, network functions virtualization (VNFs – Virtual Network Functions), Services activity, including the contribution of SixSq's activities, revenue generated by sales of software and services, which constitute a factor for improving profitability, jumped by +47%, representing 15% of H1 revenues.

Revenues up +29% in France and strong sales momentum in international business, including +48% in North America

International sales momentum was upbeat over H1 2022, with revenue up +22% and strong growth in all regions. International business accounted for 65% of total revenue over H1 2021 (vs 67% a year earlier).

Business volumes totaled €12.8 million in North America, representing strong growth of +48% relative to H1 2021 (+33% in US dollar), driven by demand for Optical transport equipment. Ekinops reached, for the first time, 20% of its revenue in North America in H1 2022 (vs. 17% in the previous year).

At mid-year, EMEA (Europe, excl. France, Middle-East and Africa), which accounts for 38% of business, generated revenue of €24.3 million, up +6% relative to H1 of the previous year.

After two years of business severely impacted by the pandemic, Asia-Pacific was able to restore growth in H2 2021. This growth trajectory continued in H1 2022 with a very sustained +80% increase in half-year sales. This performance was driven by strong traction in Access solutions, notably with an Australian Tier 1 operator entering the group's Top 10 customers. Asia-Pacific region accounted for 7% of Ekinops’ total business activity in H1 2022 (vs 5% one year prior).

After virtually stable revenue in its domestic market in 2021 and until the first quarter of the year, Ekinops restored sharp growth in France in H1 2022. With robust sales momentum in both Optical transport and Access solutions, growth amounted to +29% in France compared to H1 2021. Ekinops recorded 35% of its half-year sales in France.

FY 2022 guidance fully confirmed at mid-year

After a particularly dynamic Q1 (+20%), Ekinops continued its sustained growth trajectory in Q2 (+29%) with excellent order intake illustrating the Group's ability to capture investments from operators and enterprises, as well as the relevance of its solutions for their needs in this difficult economic context.

However, Ekinops remains vigilant regarding the components’ crisis, which is set to continue over 2022 and remain very present in coming quarters. To date, however, it has not caused any major impact on the Group’s business, which thanks to its control over its supply chain, is largely outperforming its market and competitors.

At mid-year, Ekinops confirms its annual guidance:

- robust organic growth, at least equal to the 2021 level (+12%) and pushing towards +15%;

- gross margin of between 52% and 56%, in line with its long-term ambitions and factoring in the potential impact of the supply chain crisis on electronic components;

- EBITDA margin between 14% and 18%, integrating human and technological investments to execute the new growth plan.

At the same time, Ekinops remains particularly active on the external growth front, continuing to explore all acquisitions opportunities that could create value for the company.

Didier Brédy, Chairman and CEO of Ekinops, stated:

“After a dynamic 2021 for Ekinops, this beginning of 2022 is marked by a clear acceleration in demand growth.

Illustrating this dynamism, all our business lines show strong growth, with strong traction in our Optical transport solutions, particularly in North America. This momentum puts us ahead of our target set at the time of the OTN technology acquisition in 2019, namely, to triple our sales over 5 years for this business line.

Beyond the excellent growth in sales, my greatest satisfaction is the tremendously positive feedback from our largest customers regarding our ability to deliver on schedule while the unprecedented components crisis is raging. From the beginning of the Covid crisis, we have chosen to use our balance sheet to increase our inventory, to buy certain risky components 12 to 18 months in advance, while we would buy those 6 months ahead before the crisis. These choices have proven to be right ones as they generate goodwill from our customers and allow us to win market share.”

2022 financial calendar

|

Date |

Release |

|

July 28, 2022 |

H1 2022 results |

|

October 11, 2022 |

Q3 2021 revenue |

|

January 11, 2023 |

FY 2022 revenue |

|

March 7, 2023 |

2022 annual results |

All press releases are published after Euronext Paris markets close.

About Ekinops

Ekinops is a leading provider of open, trusted and innovative network connectivity solutions to service providers around the world. Our programmable and highly scalable solutions enable the fast, flexible, and cost-effective deployment of new services for both high-speed, high-capacity optical transport as well as virtualization-enabled managed enterprise services.

Our product portfolio consists of three highly complementary product and service sets: EKINOPS360, OneAccess and Compose.

- EKINOPS360 provides optical transport solutions for metro, regional and long-distance networks with WDM for high-capacity point-to-point, ring, and optical mesh architectures, and OTN for improved bandwidth utilization and efficient multi-service aggregation.

- OneAccess offers a wide choice of physical and virtualized deployment options for access network functions.

- Compose supports service providers in making their networks software-defined with a variety of software management tools and services, including the scalable SD-WAN Xpress and SixSq Edge-to-Cloud solutions.

As service providers embrace SDN and NFV deployment models, Ekinops enables future-proofed deployment today, enabling operators to seamlessly migrate to an open, virtualized delivery model at a time of their choosing.

A global organization, Ekinops (EKI) - a public company traded on the Euronext Paris exchange operates on four continents.

Name : EKINOPS

ISIN Code : FR0011466069

Mnemonic code : EKI

Number of shares: 26,162,922