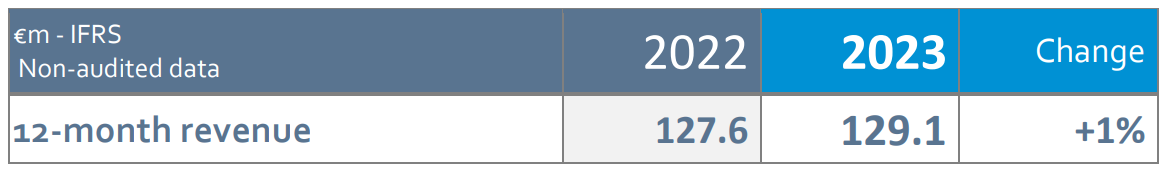

EKINOPS (Euronext Paris - FR0011466069 – EKI), a leading supplier of telecommunication solutions for telecom operators and enterprises, has published its consolidated revenue for the 2023 financial year, ending on December 31, 2023.

Sequential revenue growth of +9% in Q4 2023

Q4 2023 revenue stood at 30.3m€, versus 31.5m€ a year earlier, representing a quarterly decline of -4% (-3% at constant exchange rates). Sequentially, Q4 sales were up +9% compared with Q3 2023, which was the lowest point of the year.

At the end of the year, Ekinops continued to suffer from a deteriorated market environment, marked by the macroeconomic slowdown and a drop in demand, penalizing sales of Access equipment. Driven by numerous commercial successes and new customer wins, the Optical Transport business line, on the other hand, posted strong growth (+27% over the year), underpinned by operators' bandwidth requirements. Ekinops' consolidated FY 2023 revenue came to 129.1m€, up +1% Y-o-Y. At constant exchange rates, annual revenue was up +2%.

+27% growth in Optical Transport revenue in 2023, -15% decline in Access

As in 2022, sales of Optical Transport solutions continued their strong growth trajectory, marking a further jump of +27% in FY 2023, particularly in France and EMEA (Europe - excluding France - Middle East and Africa), thanks to the success of WDM solutions and new customer wins, notably in Eastern Europe.

In Optical Transport, which exceeded its annual sales target, 2023 was marked by a number of commercial successes in both the US and Europe, including a multi-year contract with German operator Deutsche Glasfaser at the end of the year to modernize and unify their optical transport network infrastructure using the Ekinops360 platform.

Meanwhile, Access solutions sales fell by -15% over the year, including -25% in H2 alone. Beyond a challenging comparison basis (+20% in FY 2022), business was penalized by (i) a slowdown in demand and increased caution among clients in implementing their investments, (ii) a high level of equipment inventories among major operators, and (iii) more difficult and costly access to financing sources for operators.

Share of Software & Services at 17% of FY 2023 revenue, up +12%

The contribution of Software & Services continued to increase, to stand at 17% of Group’s FY 2023 revenue, compared with 15% a year earlier. In H2 2023, the share of Software & Services reached 20% of Group’s revenue for the first time.

Over the full year, revenue generated by Software & Services rose by +12%, driven by sales of network virtualization solutions, SD-WAN solutions and services.

International sales up +8%, with double-digit growth in EMEA and North America

Ekinops posted +8% growth in FY 2023 international sales, whereas revenue in France was down -11%. The share of business generated internationally totaled 68% in FY 2023 (vs. 64% in 2022).

In North America, full-year revenue amounted to 31.7m€, up +6% Y-o-Y, despite a particularly demanding comparison basis (reminder: +56% in 2022). In US dollar , full-year growth stood at +10%. The region represented 25% of the Group's revenue in FY 2023 (vs. 23% a year earlier and 18% in 2021).

The EMEA region recorded revenue of 53.4€m in 2023, a robust increase of +23% versus the previous year. This sharp growth was primarily driven by the surge in sales of Optical Transport solutions in the region, and especially in Germany and Eastern Europe. Ekinops generated 41% of its revenue in EMEA in 2023 (vs. 34% in 2022).

Asia-Pacific, which now accounts for only 2% of Group revenue generated with just a few clients, was down -63% over the year (vs. growth of 38% in 2022).

In its domestic market, sales were down -11% compared with 2022. Sales of Access equipment, the Group's core business in France, fell by -18% over the year, mainly due to the economic slowdown and high inventory levels at major operator customers. Momentum was nevertheless still strong in Optical Transport with a leap of +57% in sales over the year. Ekinops generated 32% of its sales volume in France in 2023 (vs. 36% in 2022).

Confirmation of 2023 EBITDA margin target of between 13% and 17%

H2 2023 was harshly affected by adverse market conditions in the Access activity, against a backdrop of economic slowdown and a high level of stocks at operators.

For FY 2023, Ekinops confirms its EBITDA margin target of between 13% and 17%.

Didier Brédy, Chairman and CEO of Ekinops, said:

"Changes in the economic climate during 2023, affecting company investment policies and health, penalized our Access business in the second half of the year. In contrast, we significantly outperformed the Optical Transport market, both in Europe and the United States.

After the low point of Q3, our aim is to generate a higher level of revenue in H1 2024 than that of H2 2023. FY 2024 revenue should be driven by a rebound in Access equipment sales as the economy recovers, and by the launch of a major new optical transport product over the summer.

In terms of acquisitions, Ekinops' management remains fully mobilized, and we aim to complete one or more transactions over the coming months, while favoring non-dilutive financing."

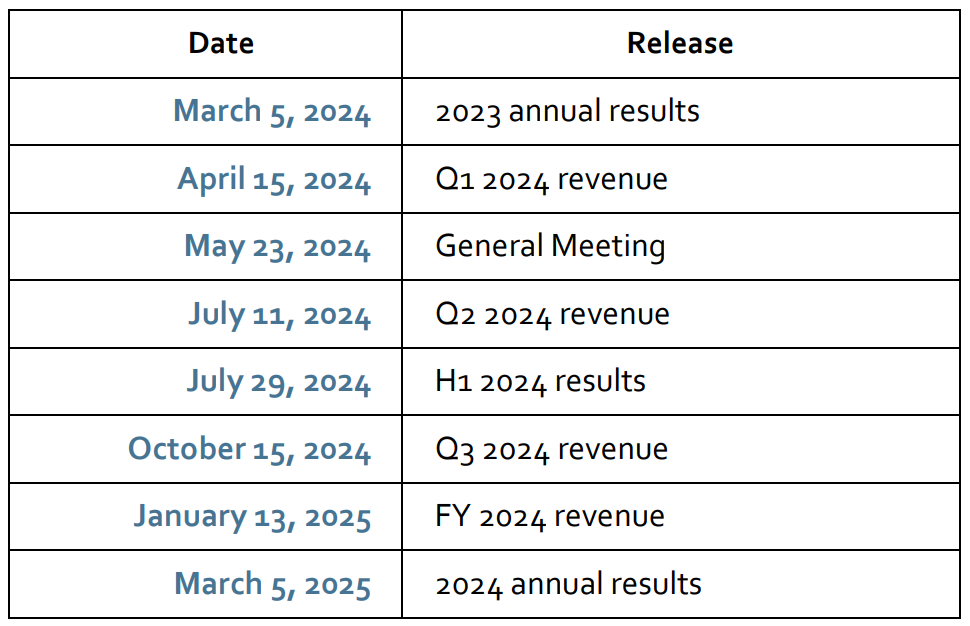

2024 financial calendar

All press releases are published after Euronext Paris market close.

About Ekinops

Ekinops is a leading provider of open, trusted and innovative network connectivity solutions to service providers around the world. Our programmable and highly scalable solutions enable the fast, flexible, and cost-effective deployment of new services for both high-speed, high-capacity optical transport as well as virtualization-enabled managed enterprise services.

Our product portfolio consists of three highly complementary product and service sets: EKINOPS360, OneAccess and Compose.

- EKINOPS360 provides optical transport solutions for metro, regional and long-distance networks with WDM for high-capacity point-to-point, ring, and optical mesh architectures, and OTN for improved bandwidth utilization and efficient multi-service aggregation.

- OneAccess offers a wide choice of physical and virtualized deployment options for access network functions.

- Compose supports service providers in making their networks software-defined with a variety of software management tools and services, including the scalable SD-WAN Xpress and SixSq Edge-to-Cloud solutions.

As service providers embrace SDN and NFV deployment models, Ekinops enables future-proofed deployment today, enabling operators to seamlessly migrate to an open, virtualized delivery model at a time of their choosing.

A global organization, Ekinops (EKI) - a public company traded on the Euronext Paris exchange operates on four continents.

Name : EKINOPS

ISIN Code : FR0011466069

Mnemonic code : EKI

Number of shares: 26,801,716