EKINOPS (Euronext Paris - FR0011466069 – EKI), a leading supplier of telecommunications solutions for telecom operators, has published its financial statements for the year ended December 31, 2019 as approved by the Board of Directors on February 25, 2020. The audit of the consolidated financial statements has been completed and the certification report will be issued after specific checks.

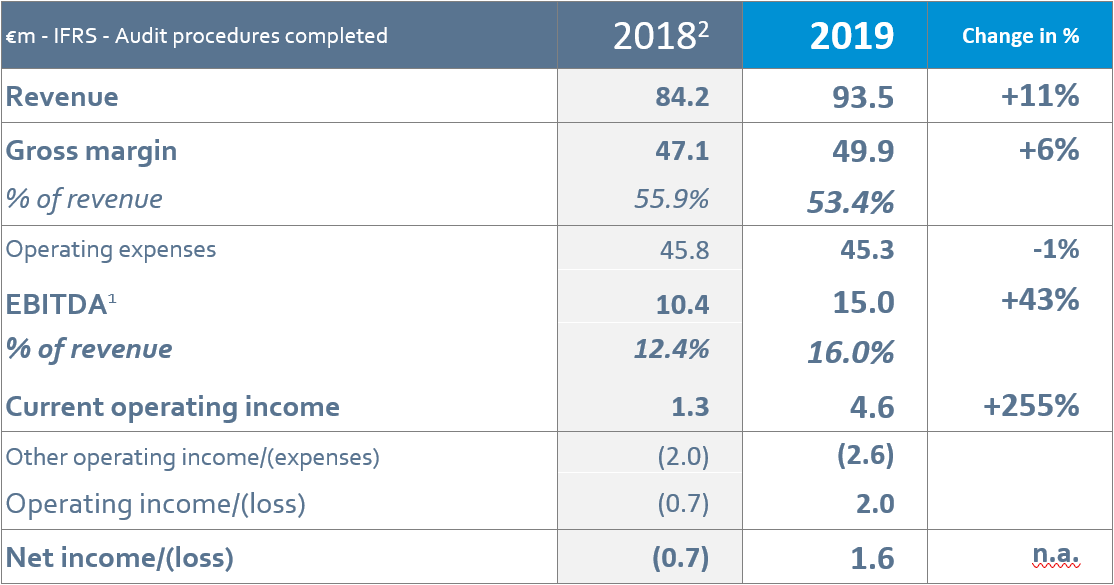

(1) EBITDA (Earnings before interest, taxes, depreciation and amortization) corresponds to current operating income restated for

(i) amortization, depreciation, provisions and write-offs, and (ii) income and expenses relating to share-based payments.

(2) 2018 data has been restated due to revaluation of the earn-out portion payment payable in shares in respect of the OneAccess acquisition. This resulted in a €1.4 million reduction in the earn-out liability as of December 31, 2018 and impacted ‘Other operating income and expenses’ (net expense of €2.0 million versus €3.4 million as reported in 2018).

EKINOPS posted consolidated full-year 2019 revenue of €93.5 million following sustained year-on-year growth of 11.0% (9.7% at constant exchange rates), including 15.0% growth (13.3% at constant exchange rates) in the second half. These results are in line with the Group’s long-term target of maintaining double-digit organic growth.

This buoyant growth largely came from strong demand for optical transport products, with the proven success of the 200G and 400G ranges. A success further illustrated by the win of several key accounts in the USA which contributed strongly to the impressive 56% growth rate recorded in the region. The revenue outside of France grew significantly in 2019 at 28.5%.

Last year, the Group made further strategic progress in virtualization, with several leading operators and service providers adopting EKINOPS products: OneOS6, OneAccess’ VNFs (Virtual Network Functions) and OVP (Open Virtual Platform). Ekinops’ leading position in virtualization was confirmed by the MEF Award in the ‘Virtualization’ category obtained in November 2019 and, more recently, by Orange Business Services’ choice of EKINOPS as a partner for its universal customer premises equipment solution (uCPE) to step up the transformation of edge networks.

Gross margin rate of 53.4% at the upper end of the target range

Gross margin amounted to €49.9 million, up 6%. The gross margin rate came to 53.4%, at the upper end of the Group’s long-term target range (50-55%), after an exceptional margin of 55.9% in 2018.

The slight year-on-year decrease is due to three factors: (i) a strong performance in 2018 driven by one-off service sales to a major client, (ii) strategic business development initiatives with two major Top 10 clients (one Asia-Pacific key account and a major European operator) leading to respective revenue growth of 48% and 82% with these two clients in 2019, and (iii) a less favorable product mix coupled with price increases affecting some electronic components.

43% EBITDA growth, record full-year EBITDA margin of 16.0%

2019 EBITDA came to €15.0 million, up 43% from 2018 driven by tight management of the cost structure. Accordingly, operating expenses fell 1% versus 2018, with reductions seen in R&D (down 3%) and sales and marketing expenditure (down 5%).

The main reasons for the leveling of operating expenses were: (i) the full-year impact of the reorganization and optimization measures implemented in 2018 following the OneAccess acquisition, (ii) reduced hiring requirements after the intake of 25 R&D engineers based in Campinas (Brazil) following the July acquisition of OTN technology, and (iii) a €1.3 million increase in 2019 grants for innovation and research tax credit versus 2018.

Furthermore, application of IFRS 16 increased 2019 EBITDA by €1.9 million.

2019 EBITDA margin came to 16.0% (14.0% excluding IFRS 16 impact) versus 12.4% in 2018.

After net depreciation, amortization and provisions (€8.6 million) and non-cash expenses relating to share-based payments (€1.8 million), current operating income amounted to €4.6 million (4.9% of revenue) compared to €1.3 million last year (up 255%).

Other operating income and expenses amounted to a net expense of €2.6 million (vs €2.0 million in 2018), mainly consisting of fees and charges relating to acquisitions. Operating income amounted to €2.0 million (vs a €0.7 million loss in 2018).

Net income came to €1.6 million, compared to a €0.7 million loss in 2018.

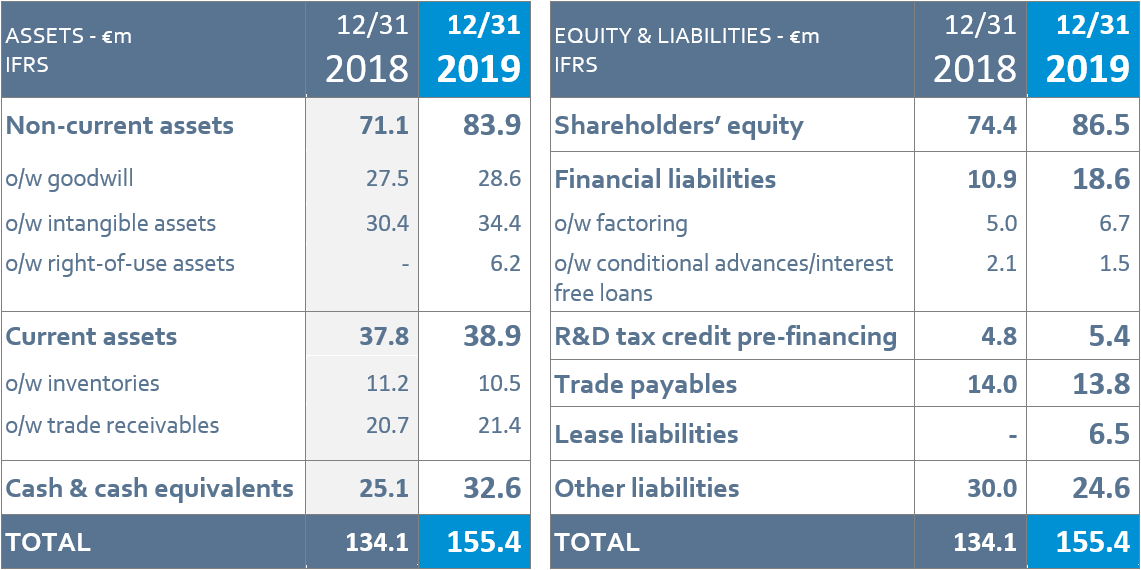

€14.0 million net cash[1] as of December 31, 2019

During 2019 EKINOPS generated operating cash flow of €10.5 million.

Cash flow from investing activities amounted to €16.1 million comprising €3.9 million capex (non-current assets and R&D capitalization) and a €12.3 million outflow representing the acquisition of OTN technology in July 2019 and payment of the last earn-out installment in respect of the OneAccess acquisition.

Cash flow from financing activities amounted to a €13.1 million inflow, which includes a net €7.3 million capital increase through private placement carried out in June 2019 to finance the OTN acquisition and new bank borrowings totaling €7.9 million net of repayments.

The overall change in cash and cash equivalents was a €7.5 million increase in 2019.

Outlook

After the growth achieved in 2018, 2019 results fully reflect the successful merger with OneAccess and the high value-added generated.

Over the coming months, the Group plans to stay focused on high value-added applications such as SD-WAN (Software-Defined Wide Area Network), uCPEs, OneOS6, VNFs, services, 1G/10G routers, OTN and SDN software.

Recent achievements in virtualization (MEF Award, Orange Business Services) confirm the merits of the Group’s innovator positioning in this sector and ambition to establish itself as a leading supplier of new-generation virtualization solutions to operators.

2020 financial targets

As the year 2020 gets underway, EKINOPS is confirming its goal of delivering double-digit annual organic growth over the long term, as achieved in 2018 (14% pro forma growth) and 2019 (11%).

The Group’s upselling strategy driven by increasing sales of software solutions over the coming years strengthens its confidence in achieving its gross margin target of 50-55%, above the industry average.

Lastly, in terms of operating performance the Group is confirming its target of keeping the increase in expenses down to €2-4 million (excluding depreciation and amortization charges and non-recurring expenditure) versus 2019, in view of the full-year consolidation of the new OTN business and the hiring required to support growth.

Potential impact of coronavirus epidemic on Ekinops’ business

Along with the publication of its 2019 annual results, EKINOPS wishes to inform the market of the possible impact of the coronavirus epidemic and production line shutdowns in China on its business.

So far, the epidemic has not had a major impact on the Group’s business.

It is reminded that the Group’s equipment is manufactured entirely in Europe at assembly plants located in France, Belgium and Hungary.

However, supply issues affecting some components manufactured in China could cause delays in equipment deliveries to clients. Meanwhile, the Group is looking into alternative supply solutions for some categories of components and parts.

The Group will keep its shareholders and the market informed of any related material developments affecting its business.

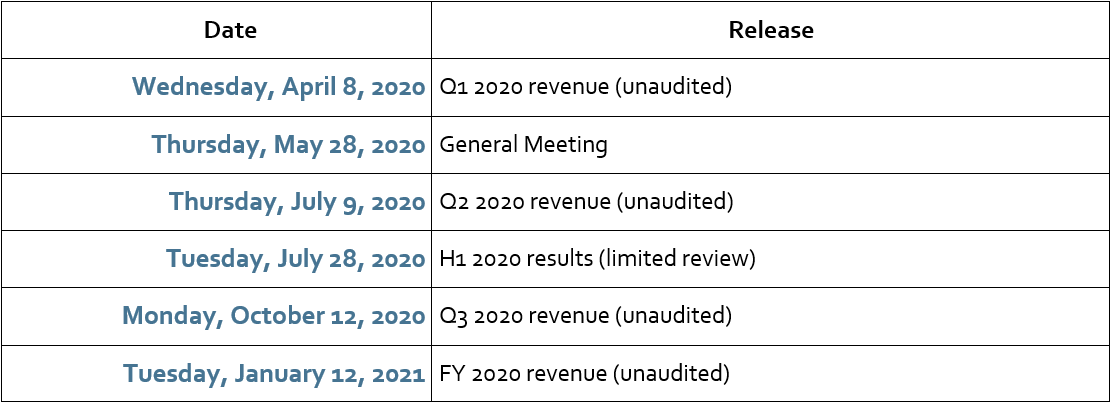

Financial reporting calendar

All press releases are published after Euronext Paris market close.

([1]) Net cash = cash and cash equivalents – borrowings (excluding bank debt relating to CIR pre-financing and IFRS 16 lease liabilities)

About Ekinops

EKINOPS is a leading provider of open and fully interoperable Layer 1, 2 and 3 solutions to service providers around the world. Our programmable and highly scalable solutions enable the fast, flexible and cost-effective deployment of new services for both high-speed, high-capacity optical transport as well as virtualization-enabled managed enterprise services.

Our product portfolio consists of three highly complementary product and service sets: EKINOPS 360, OneAccess and Compose. EKINOPS 360 provides optical transport solutions for metro, regional and long-distance networks with WDM for high-capacity point-to-point, ring and optical mesh architectures, and OTN for improved bandwidth utilization and efficient multi-service aggregation.

OneAccess offers a wide choice of physical and virtualized deployment options for Layer 2 and Layer 3 access network functions.

Compose supports service providers in making their networks software-defined with a variety of software management tools and services, including the scalable SD-WAN Xpress. As service providers embrace SDN and NFV deployment models, EKINOPS enables future-proofed deployment today, enabling operators to seamlessly migrate to an open, virtualized delivery model at a time of their choosing.

A global organization, EKINOPS (EKI) - a public company traded on the Euronext Paris exchange - is headquartered in Lannion, France, and EKINOPS Corp., a wholly-owned subsidiary, is incorporated in the USA.

Name : EKINOPS

ISIN Code : FR0011466069

Mnemonic code : EKI

Number of shares:24,163,017