EKINOPS (Euronext Paris – FR0011466069 – EKI), a leading supplier of telecommunications solutions for telecom operators and enterprises, has published its H1 2022 financial statements (for the period ended June 30, 2022) as approved by the Board of Directors on July 27, 2022. The statutory auditors conducted an interim review of these half-year financial statements.

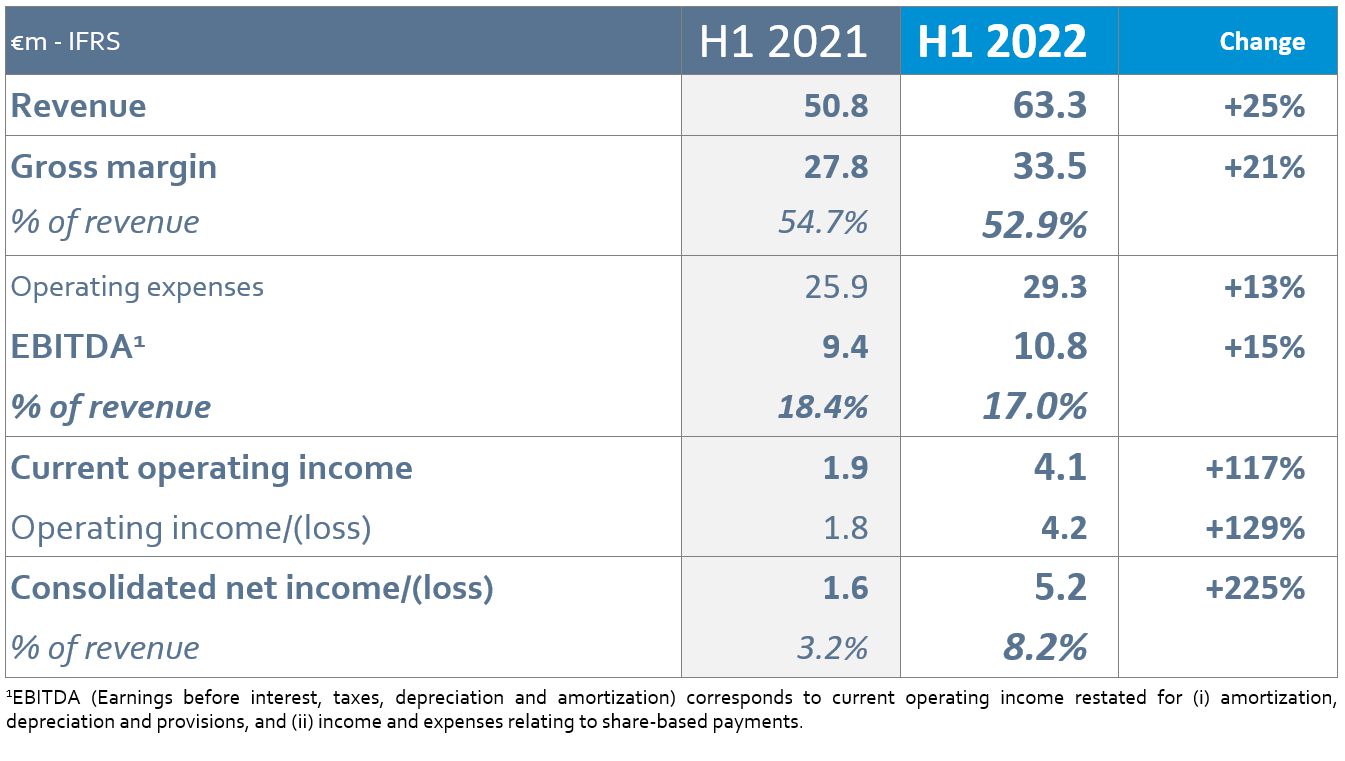

Record half-year revenue with 25% growth

At the end of the first half of 2022, Ekinops’ consolidated revenue stood at €63.3 million versus €50.8 million in the previous year, representing robust growth of 25%. At constant scope and exchange rates, half-year growth was 20%.

This trend is the result of solid momentum in all the Group’s activities: +31% for optical transport equipment, +21% for Access solutions and +47% for software and services, which now represent 15% of the group’s revenue as a result of the success of SDN (Software Defined Networks) and virtualization solutions.

In geographic terms, half-year sales grew significantly by 48% in North America (33% in USD), reaching 20% of the group’s business for the first time. Asia-Pacific continued on the growth trajectory that began in H2 2021 with a very sustained 80% increase in half-year sales. Sales in EMEA, in which 38% of the group's activity is generated, grew 6% compared with the same period in the previous year. After a first quarter in which activity in France remained virtually stable, the group’s sales returned to steady growth of 29% in the semester.

Gross margin of 52.9%, within the target range, despite the components crisis

As a result of the very strong sales momentum over the semester and the increase in the share of software and services in the business mix, gross margin for the period was €33.5 million, up 21% from the same period a year earlier.

Gross margin thus represented 52.9% of consolidated revenue in H1 2022. This figure is in line with the group's targets and is within the long-term target range (52%-56%), despite the components crisis, which is continuing in 2022.

EBITDA margin of 17.0% in H1 2022, towards the top of the target range

As of June 30, 2022, H1 EBITDA was €10.8 million versus €9.4 million in H1 2021, with a contained increase in operating expenses (13%). At the same time, the Group made the investments needed to support its growth and development (24 net new hires in the period, and equipment purchases, mainly for R&D purposes).

The EBITDA margin stood at 17.0% in H1 2022, at the high end of FY 2022 target range (14%-18%), versus 16.9% for FY 2021.

After net depreciation, amortization and provisions (€5.3 million, of which €3.0 million in amortization related to technologies and purchase price allocation) and non-cash expenses relating to share-based payments (€0.9 million) and the associated employer contributions (€0.4 million), current operating income (EBIT) amounted to €4.1 million in H1 2022, representing significant growth of 117% from the previous year. The current operating margin was 6.5% of revenue, versus 3.7% in H1 2021. Excluding amortization related to the intangible assets identified post purchase price allocation, pro forma EBIT was 11.2%.

In the absence of other material operating income and expenses in H1 2022, operating income came to €4.2 million versus €1.8 million a year earlier, representing growth of 129%.

Record net margin of 8.2% in H1 2022

After accounting for €0.9 million in financial income from foreign exchange gains and the recognition of a positive tax result of €0.2 million, net income for the period leapt by +225% to €5.2 million, higher than that achieved in FY 2021 (€4.8 million).

The net margin for H1 2022 was 8.2%, a record level, versus 3.2% a year earlier and 4.6% for the whole of the FY 2021.

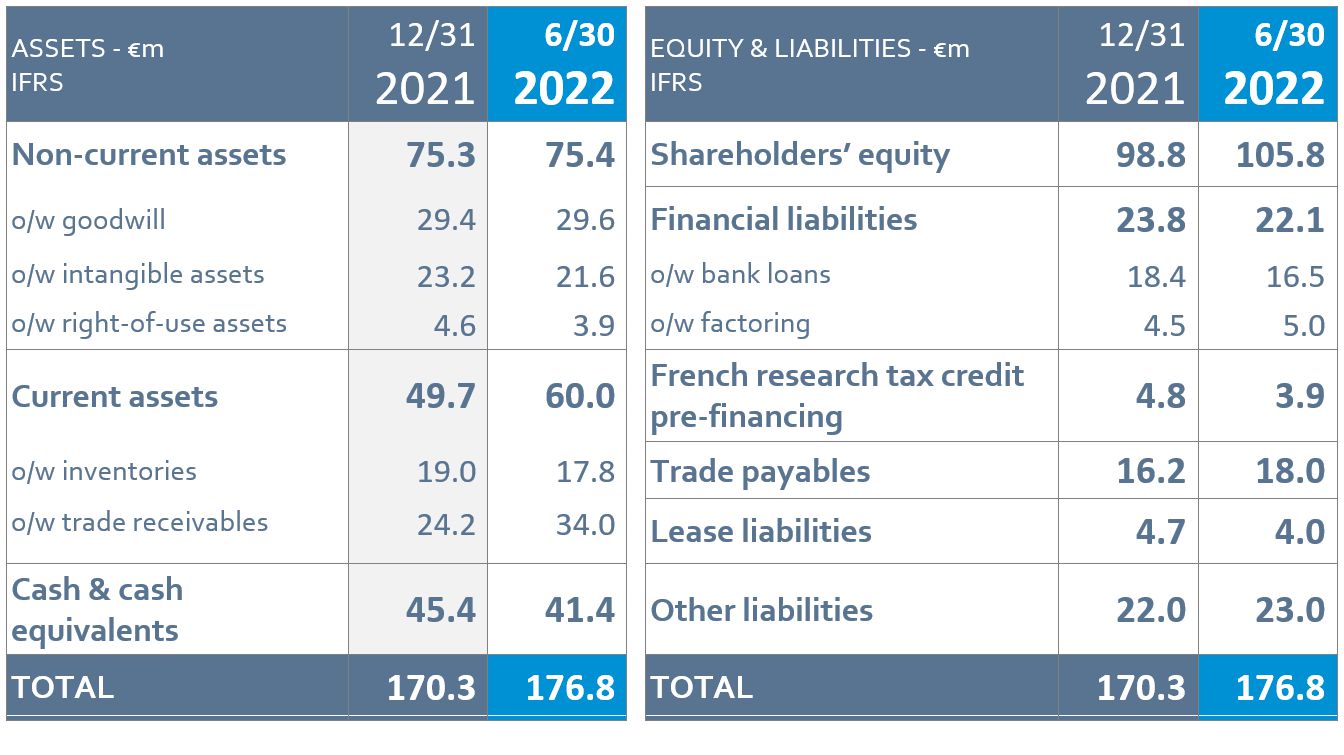

Net cash[1] of €19.3 million at June 30, 2022

In H1 2022, Ekinops generated cash flow of €10.7 million versus €9.2 million in H1 2021, a 17% increase.

With working capital increased by €8.3 million, versus a change in working capital of €4.3 million a year earlier, as a result of very buoyant levels of activity, operating cash flow was €2.2 million versus €4.6 million in H1 2021.

Cash flow from investing activities amounted to a €2.8 million outflow (versus €2.1 million a year earlier), with CAPEX of €2.7 million, comprising €1.6 million of capitalized R&D expenditure and €1.1 million

of expenditure on fixed assets.

Cash flow from financing activities was -€3.6 million, including -€3.1 of repayments under bank loans.

No new loans were taken out during the semester.

As of June 30, 2022, cash and cash equivalents stood at €41.4 million, for financial borrowings[2]

of €22.1 million. Ekinops’ financial situation was particularly solid at the end of the period, with net cash[3] of €19.3 million and shareholders’ equity of more than €100 million.

Annual revenue guidance increased for 2022

2021 was a very dynamic year for the group and the results in H1 2022 reflect an acceleration in growth and continued high profitability, illustrating Ekinops’ outperformance of its markets and its main competitors.

Beyond these very good results, which illustrate Ekinops' ability to capture investments from operators, as well as the relevance of its solutions for their needs in a more difficult economic environment, H1 2022 was marked by the strong traction generated by all the group’s business lines, achieving very strong shipping and delivery levels despite the components crisis.

The Company nevertheless continues to pay close attention to this unprecedented crisis, which is likely to remain a key issue in the coming quarters. It has not, however, had any major impact on the group’s activity thanks to its effective management of its supply chain and has demonstrated its agility in sourcing and managing its inventories since the start of the crisis.

As of June 30, 2022, Ekinops raises its organic growth guidance and reiterates its gross margin and EBITDA targets for 2022 fiscal year:

- organic growth over +15%, versus more than 12% initially targeted;

- gross margin of between 52% and 56%, in line with the long-term goal and factoring in the impact of the supply chain crisis on electronic components;

- EBITDA margin between 14% and 18%, integrating human and technological investments to execute the new growth plan.

Given its sound financial position, Ekinops continues to very actively pursue external growth and explore all acquisition opportunities that could create value for the company.

2022 financial calendar

|

Date |

Release |

|

October 11, 2022 |

Q3 2021 revenue |

|

January 11, 2023 |

FY 2022 revenue |

|

March 7, 2023 |

2022 annual results |

All press releases are published after Euronext Paris market close.

[1] Net cash = cash and cash equivalents – borrowings (excluding bank debt relating to French research tax credit (CIR) pre-financing and IFRS 16 lease liabilities)

[2] Excluding bank debt relating to research tax credit pre-financing and IFRS 16 lease liabilities

[3] Net cash = cash and cash equivalents – borrowings (excluding bank debt relating to French research tax credit (CIR) pre-financing and IFRS 16 lease liabilities)

About Ekinops

Ekinops is a leading provider of open and fully interoperable Layer 1, 2 and 3 solutions to service providers around the world. Our programmable and highly scalable solutions enable the fast, flexible and cost-effective deployment of new services for both high-speed, high-capacity optical transport as well as virtualization-enabled managed enterprise services.

Our product portfolio consists of three highly complementary product and service sets: EKINOPS360, OneAccess and Compose.

EKINOPS360 provides optical transport solutions for metro, regional and long-distance networks with WDM for high-capacity point-to-point, ring and optical mesh architectures, and OTN for improved bandwidth utilization and efficient multi-service aggregation.

OneAccess offers a wide choice of physical and virtualized deployment options for Layer 2 and Layer 3 access network functions.

Compose supports service providers in making their networks software-defined with a variety of software management tools and services, including the scalable SD-WAN Xpress.

As service providers embrace SDN and NFV deployment models, Ekinops enables future-proofed deployment today, enabling operators to seamlessly migrate to an open, virtualized delivery model at a time of their choosing.

A global organization, Ekinops (EKI) - a public company traded on the Euronext Paris exchange operates on four continents.

Name : EKINOPS

ISIN Code : FR0011466069

Mnemonic code : EKI

Number of shares: 26,162,922