EKINOPS (Euronext Paris - FR0011466069 – EKI), a leading global supplier of telecommunications solutions for telecom operators, has published its consolidated revenue for 2018. OneAccess and its subsidiaries have been fully consolidated in the Group financial statements since October 1, 2017.

Proforma annual growth of 14%

2018 profit margins expected to largely exceed targets

EKINOPS posted Q4 2018 consolidated revenue of €21.20 million, an increase of 9% from Q4 2017 (no change in consolidation scope between the two periods).

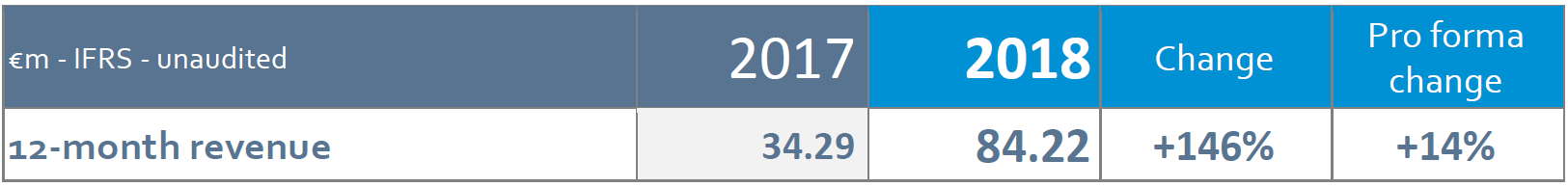

Full-year consolidated revenue thus amounted to €84.22 million, up 146% as reported.

On a pro forma basis, with the consolidation of OneAccess and its subsidiaries backdated to January 1, 2017, year-on-year growth came to 14% (vs 2017 pro forma revenue of €73.8 million), up 19% in the second half alone.

2018 revenue therefore exceeded the annual target raised from €80 million to €82 million in mid-September.

32% growth for the Top 10 clients

Business momentum in 2018 was particularly strong with major operators and service provider clients. Average growth for the Top 10 clients therefore amounted to 32% in 2018 (vs. 2017 on a pro forma basis), and 35% for Tier 1 operators in the Top 10.

The top ten clients, six of which are Tier 1 operators, therefore account for 62% of the Group’s business in 2018, up from 54% the previous year.

These excellent results reflect the strong interest for Ekinops’ technological solutions, at a time when network layers are converging and virtualized services and Software-Defined Networks (SDN) architectures are being deployed.

58% of business generated abroad in 2018

In geographical terms, France and EMEA (Europe excluding France, Middle East & Africa) are the Group’s core regions, accounting respectively for 42% and 37% of annual sales (vs 34% and 46% in 2017 on a pro forma basis).

Asia Pacific posted a solid sales performance in 2018, mainly in Australia, and now accounts for 9% of total business (vs 7% in 2017).

Lastly, the Americas account for 12% of total business, stable compared to 2017 (13%). This region, where EKINOPS recently opened its US head office near Washington, will be a real growth driver over the coming years, with major growth opportunities already in the pipeline.

Profit margins expected to exceed targets: full-year EBITDA margin at least equal to H1 margin

2018 was marked by the success of the EKINOPS and OneAccess merger, as evidenced by outstanding half-year results and now by the fact that the full-year revenue target has been exceeded.

In view of these results, the full-year EBITDA margin should largely exceed the annual target already raised to 5% in mid-September.

EKINOPS now expects the full-year EBITDA margin to be at least equal to the 9.5% margin recorded in H1 2018.

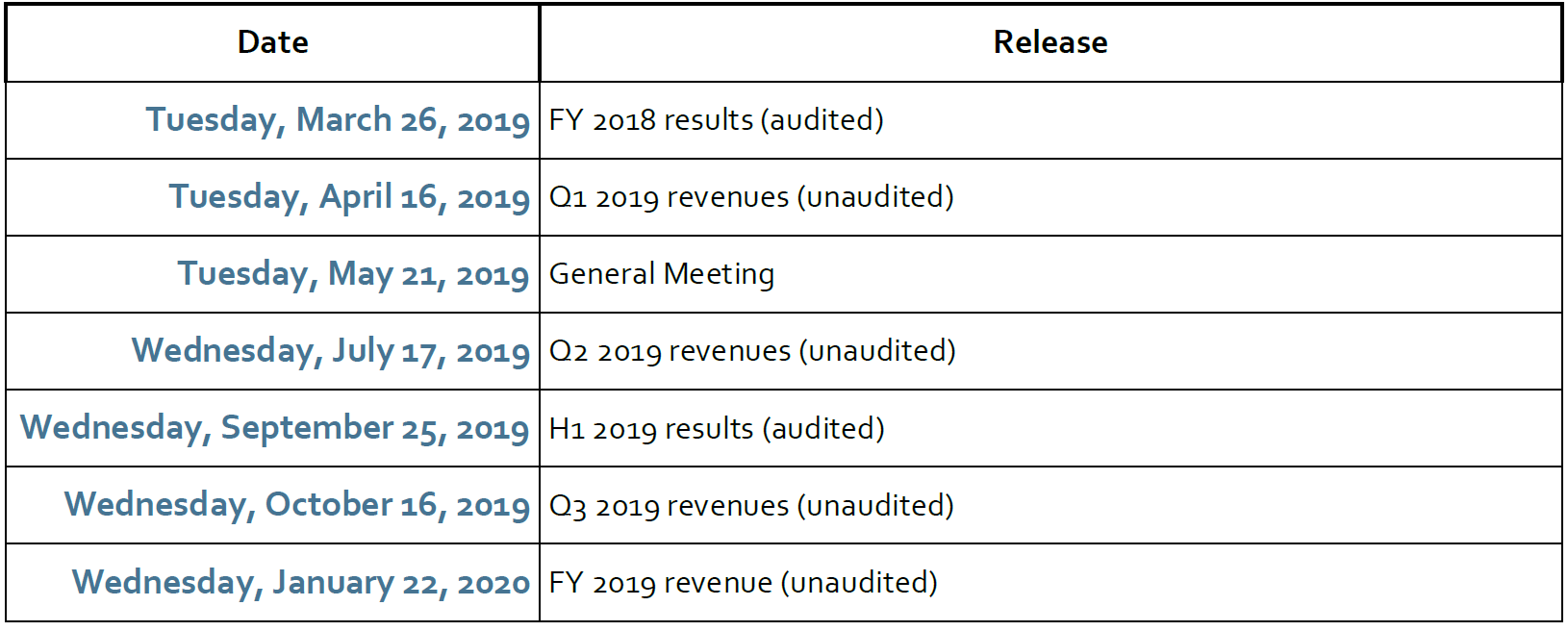

2019 financial calendar

All press releases are published after Euronext Paris market close.

About Ekinops

EKINOPS is a leading provider of open and fully interoperable Layer 1, 2 and 3 solutions to service providers around the world. Our programmable and highly scalable solutions enable the fast, flexible and cost-effective deployment of new services for both high-speed, high-capacity optical transport as well as virtualization-enabled managed enterprise services.

Our product portfolio consists of three highly complementary product and service sets: EKINOPS 360, OneAccess and Compose. EKINOPS 360 provides optical transport solutions for metro, regional and long-distance networks with WDM for high-capacity point-to-point, ring and optical mesh architectures, and OTN for improved bandwidth utilization and efficient multi-service aggregation.

OneAccess offers a wide choice of physical and virtualized deployment options for Layer 2 and Layer 3 access network functions.

Compose supports service providers in making their networks software-defined with a variety of software management tools and services, including the scalable SD-WAN Xpress. As service providers embrace SDN and NFV deployment models, EKINOPS enables future-proofed deployment today, enabling operators to seamlessly migrate to an open, virtualized delivery model at a time of their choosing.

A global organization, EKINOPS (EKI) - a public company traded on the Euronext Paris exchange - is headquartered in Lannion, France, and EKINOPS Corp., a wholly-owned subsidiary, is incorporated in the USA.

Name : EKINOPS

ISIN Code : FR0011466069

Mnemonic code : EKI

Number of shares: 21,529,161